We have seen this movie before. Its called "Back to the

Future". In the mid-80s, the second edition of the movie series

predicted flat screen TVs, fingerprint scanners, video conferencing and

flying cars in 2015.

However, the first edition of the movie was the most

memorable one going back to the past from 1985 to 1955.... But now that

we are in 2015, lets take a dive back to the mid-80s when the movie was

released... Incidentally, its also the time when there was another

movie playing in real life in technology: called the

Telephony-to-Internet saga.

A worldwide sprawling synchronous infrastructure called the

telephone network sized for peak demand, i.e. capacity sized to serve

the largest amount of simultaneous demand (with very high probability).

When a phone call is made, instantaneously an end to end "circuit" and

its associated capacity is reserved to allow the call to be made. A

shift from analog to digitization of the telephony infrastructure:

time-division multiplexing (TDM), optical transport of large bundles of

time-synchronized digital information (SONET). The emergence of a few

new applications (fax, email) that rode on top of the digitized

infrastructure as an overlay network. The emergence of a small amount of

buffering or storage capacity to temporarily store "packets" of demand

at the overlay nodes (both at the source and intermediate "routers"),

supporting the idea of "packet switching" which admitted asynchrony and

allowed the capacity of routers to be sized above average demand, but

well below peak demand. The emergence of end to end decentralized

control algorithms (carrier sense multiple access & randomized

controls in Ethernet, decentralized flow control in TCP) allowed demand

to be responsive and shaped dynamically to match the actual capacity on

the paths (instead of reserving peak capacity as in telephony

circuits). Application services like email which appeared to be worse

than the current highly reliable telephone voice service, but much

better and quicker than snail mail and memos. And finally the emergence

of HTTP, web browsers and the WWW. The rest, as they say, is history.

Recently Whatsapp allows users to make calls via mobile devices to other

mobile device users, tied to their phone numbers, symbolizing how voice

has transitioned to another application over the Internet.

If you look back at the abridged history, the three pivotal

technologies that underpinned the Telephony-to-Internet transformation

were:

(a) digitization of infrastructure that allowed overlay applications over a synchronous infrastructure sized for peak demand

(b) the introduction of buffering (i.e. storage), and the

notion of asynchronously switched "packets" instead of

time-synchronized switching of bits (or bit-bundles)

(c) the emergence of decentralized controls (embedded in

Ethernet, TCP/IP, and inter-domain routing policies) that allowed demand

to dynamically respond to capacity available

Peak Energy Techno-Economics

While the analogy is not perfect, the electricity grid is

displaying a number of similarities so that we can selectively learn the

right lessons from history. For instance, to understand the equivalent

analog of (a) we need to appreciate the economic implications of a

synchronous infrastructure designed for peak demand and what degrees of

freedom allow us to "overlay" flexible supply/demand sources on it. When

we look at graphs as the picture below which show rapid growth of clean

energy or renewable options (eg: solar / wind) in the future, it is

important to understand the nature of these sources (solar, wind) are

fundamentally different, amenable to IT-driven management and some

lessons from history could be valuable as analogs.

The electricity grid is sized for (an estimate of) peak

demand, and operates synchronously, i.e. when you turn on a switch for

your lamp, a signal via grid frequency is instantly conveyed to remote

electricity generators which spin up or down slightly to supply your

lamp's needs in real-time. In countries like India, where even in urban

centres, often there is not enough supply available (or economically

contracted by the utility) to meet demand, customers have to bear a

power cut. This power outage is often unscheduled, and the situation is

worse in rural settings, where either the grid does not even reach them

or even if it does, power supply is available only for a few hours of

the day. The assets deployed both on the grid side and consumer side are

essentially idle during power cuts, a huge opportunity cost. A

peak-demand sized infrastructure is quite expensive, compared to an

infrastructure that could be sized somewhere between peak and average

demand (and the difference is managed smartly). This "peaking" effect is

also reflected in wholesale spot prices of electricity in such markets,

where peak spot prices tend to be 5-10X costlier than at other times

(which is why it is economized on by utilities). Utilities also maintain

spinning generation reserves based upon natural gas or diesel to handle

peaks and they are very expensive, and used only for a few hours in the

day.

The need for peaking capacity has only intensified over the decades

and is being further intensified due to the uptake of renewables. The

illustration below shows how the demand in ISO-NE (New England in USA)

has evolved. Think of it as a frequency histogram, and it is saying that

the top 500 hours (top percentile of load) occurs with very small

frequency, i.e. a few hours or days for the entire year, but spinning

reserve generation capacity, transmission and distribution capacity

(poles, wires, power systems) has to be peak provisioned 24 x 365 to

ensure reliability. This is why the tarriff structure in many regions

(eg: California) is tiered to discourage peak demand (or large levels of

demand, which correlates with users who contribute to peak demand).

This is also why enterprises (commercial/industrial energy users) pay

"demand charges" by KW-peak, i.e. peak-power they consume (to reflect

the grid sunk investment costs they drive), even if they cross that

level only for a few minutes in a month.

Overlay Technologies for the Energy Infrastructure:

If we can introduce "overlay" technology that is cheaper,

but allows the offsetting of this peak demand, its economic value would

be the capex/opex saved by offsetting peak capacity required otherwise.

We could achieve this either by (i) generating energy spatio-temporally

matched to when/where peak demand occurs, or (ii) storing energy (in

thermal, chemical forms), or (iii) time-shifting ("when") /

space-shifting ("where") demand or supply to arrange the "when-where"

matching of demand / supply (i.e. virtual storage), It is worth

re-emphasizing that the economically relevant comparable at the margin

is not average energy price, but the peak (or tiered) energy price

applicable to that marginal unit of energy used.

Consider method (i) where we overlay renewable generation

matched to consumption. Solar energy generated at homes in hot locations

(eg: Arizona, Middle East, India etc), tends to roughly coincide with

peak demands for energy without any further intervention. In contrast

wind energy that blows faster at night, and is remote (i.e. it has to

compete at wholesale, not retail prices) may be less valuable

economically purely from a timing/coincidence of demand perspective.

This relationship of economic value to coincidence of supply/demand

means that it is more valuable to have a low capacity-factor generator

like Solar (i.e. producing on average less than its peak rating) than a

higher capacity factor resource like Wind which may not be in production

coincident with peak demand. However it is important to temper this

point noting that as Solar penetration increases, the peak net demand

will shift to the evening time (also called the "duck curve" effect),

and the value of an overlay technology like wind or storage may be

higher in that context.

The second pattern (ii) is "overlay" technology such as

battery storage (or other forms of energy storage like thermal storage).

Tesla Energy recently announced a 10 kWh PowerWall battery for homes

priced at $3500 for 10kWh, or $350/kWh (wholesale price prior to

installation/inverter costs). Given its 10 year warranty, 365 days/year,

or approx 3500 cycles, which implies a simple levelized cost of

350/3500 = 10 cents / kWh LCOE (ignoring other costs and discounting

cash flows). If the user has sunk costs in solar at home, then at the

margin, time-shifting the solar energy to offset peak electricity prices

would be attractive if this arbitrage was worth at least 10 c/kWh. The

ability to provide other services (eg: backup power during outages) is

not factored.

The third pattern (iii) is where demand and supply do not

coincide, and beyond batteries, a set of predictive analytics and

control can be used to match them spatially ("where") and temporally

("when"). IBM Research in partnership with clients has

pioneered a number of cloud-based insights capabilities for

demand/supply management for utilities via the Smarter Energy Research

Institute (SERI). On the decentralized demand response front (i.e. the ability

to make appliance energy demands flexible), IBM Researchers developed an

innovation called nplug motivated by power-cuts in India which allows

at a plug level the ability to shift demand automatically to match

capacity (as implicitly inferred by analyzing grid voltage) without need

for any price signal, communication or coordination protocol with

centralized entities. This was also inspired by the randomized

distributed control methods used in Ethernet, but adapted to the grid.

As we can see in all these examples of "overlays", information

technology (analytics, optimization, controls) needs to be interwoven

with energy technology (solar, wind, grid, battery), and with an

awareness of the economic, policy, technical context, the entire

"overlay package" should perform the "when-where" matching of demand and

supply.

Energy Storage: Ability to Absorb and Manage Uncertainty

Lets move on to (b), the impact of energy storage beyond

the "peak-demand" driven economics of synchronous infrastructure. To

understand this, we need to come back to the shift from

circuit-to-packet switching. Lets ask the question: "What is a telephone

"circuit" really?" A circuit uses signaling at call set up and locked

down (i.e. reserved) capacity end to end. From a queueing perspective

(see diagram below) this set up a D/D/1 queue time synchronously, i.e.

deterministic input feeding a deterministic output. Elementary D/D/1

queueing analysis states that if capacity is matched to (peak) demand,

the amount of buffers is just 1 unit (i.e. effectively zero). If there

was no capacity available at the time of a call, a circuit could not be

established in signaling, and a call would be rejected (similar to power

cuts in India or rolling blackouts when there is no capacity; and huge

spikes in wholesale market price for capacity 10X greater than normal

during such demand spikes). The telephony "switch" uses

time-synchronization to avoid the need for buffering, and literally

switches bits from its input to its output port instantaneously. Packet

switching's fundamental abstraction - a set of bits, with a header

allowing it to be self sufficient - allowed those set of bits to be

buffered at "routers" or "caches" or "storage" more generally.

Here is the key insight: Buffers or energy storage imply that the queueing disciplines could admit random arrivals and random departures; and packet switched networks allowed flexible networks of such queues M/M/1 being the simplest. However if the randomness

of demand/supply could be "shaped" (eg: by shaping the statistics,

truncating tail behavior) or managed/controlled end-to-end (or even

locally) to match demand/supply , the residual externality (or

mismatch) can be minimized. It is important to realize that with good

matching, the "peak" not does not just shift around, but it is

attenuated through clever spatio-temporal matching and smoothing. The

combination of storage and smart controls/optimization driven by

predictive analytics will allow energy storage to penetrate faster and

have a greater transformative effect on the grid. The degrees of freedom

for such uncertainty management, shaping and "when-where" matching of

demand/supply are numerous and specific to the nature of individual

technology options (renewables, storage, grids (DC/AC), power

electronics) which allows a myriad set of formulations and contexts. But

the demand-supply management and matching problem under uncertainty,

and with energy storage is fundamentally an opportunity for information

technology.

Decentralized Control / Management: Towards an Internet-of-Energy-Networks

The third important lesson from the Telephony-to-Internet

saga is the importance of de-centralized controls/management. At a basic

level, the decentralized controls can help locally shape the nature of

randomness of demand / supply and optimize the amount of storage or

external grid or policy support needed to accomplish the matching. We

have seen this earlier when we mentioned the nplug technology for

distributed demand response inspired by Ethernet-style controls. But

beyond this, decentralized controls along with modular technology at

lower costs (eg: as is happening with distributed solar, battery,

demand-management systems), fundamentally empower the end-user or

customer to take control of their choices (in this case energy choices).

Remember the AT&T monopoly of the telephone network that got

transformed into an interacting network of autonomous systems (with many

market participants)? We are seeing this happen in the Energy ecosystem

both at the home level (with the explosive growth of distributed

solar), and at the commercial / industrial level (eg: Apple's recent

$850M investment to procure 130 MW solar power from FirstSolar, or

Walmart's announcement to cover all its roofs to generate over 100MW).

Note that in the context of enterprises with distributed operations, we

could imagine a cloud-based service to manage the energy resources

across sites of say, Wal-Mart.

Beyond these "self-service" models where a consumer

does-it-all by themselves, we are also starting to see the rapid

emergence alternative energy service companies like SolarCity, SunEdison

etc who package installation and management of multiple energy

resources (solar, battery, demand response (eg: NEST)) & outage

tolerance possibly in microgrid configurations, with a package of

financing and policy incentives as well. The notion of microgrid is

important because it allows the emergence of "autonomous systems" that

can interconnect. Microgrid "domains" will serve to take control of

energy choices (storage, renewables, demand management, DC/AC grid

choices) within the domain, but will be interconnected to other

microgrids and to utility grids. This is akin to the emergence of

"Internet Service Providers" (ISPs) in the 1990s like AOL, Excite@Home

and others who overlaid their internet services or access services via

modems atop the existing telephony infrastructure, and offering email

etc. Once this trend gets established and the new service providers

grow, they will necessarily need to interconnect with the existing

service providers and with each other. This tends to drive the market

structure from a single switched network to a "network" of networks

model, which was the genesis of the term "Internet". This interaction

needs to be governed so that one provider takes responsibility for the

choices they make and the externalities they impose on other providers:

this is managed through inter-domain routing protocols on the Internet.

When you examine some of the higher penetration solar regions like

Hawaii, we are starting to see externalities and instabilities being

imposed by solar on the grid operator (HECO), and the need for urgent

solutions to manage this via a combination of energy storage and

distributed controls. It is useful to emphasize here that the notion of

users defecting en mass from utility grids is a short sighted view (as

much as local area networks and enterprises defecting from wide area

networks in the Internet): the internet transformation has taught us

that interconnection by itself has greater value.

Information technology has a huge role in defining and

managing this set of uncertainties and governing the economic spillover

effects, again closely integrated with the technology options at the

energy level (renewables, grid, energy storage) and financial/policy

levels. It is important to note that "decentralized" means that no

single entity has overriding control/bargaining power, but the

granularity of decentralization could evolve as a function of

technological and economic constraints. For instance, managing a large

number of commercial sites could be done via a cloud-based service, but

under the autonomous management of an entity like Walmart with their own

selection of vendors. Similarly, data centres and cloud providers could

choose to go towards renewable-powered DC grids locally; or the

emergence of micro-grids that are DC-based typically in a community- or

corporate-ecosystem setting (ranging from Rural Electrification plays to

managed EV-fleets such as e-Bike/e-Scooter share programs, e-Taxi

fleets, or e-Logistics fleets etc). A large range of integrated energy

products that embed IT / financial innovation (eg: solar lights with

e-financing/payment via mobile phones in Africa to a distributed fleet

of e-transport options that personalise public transportation, with the

ability to space-time shift renewable energy).

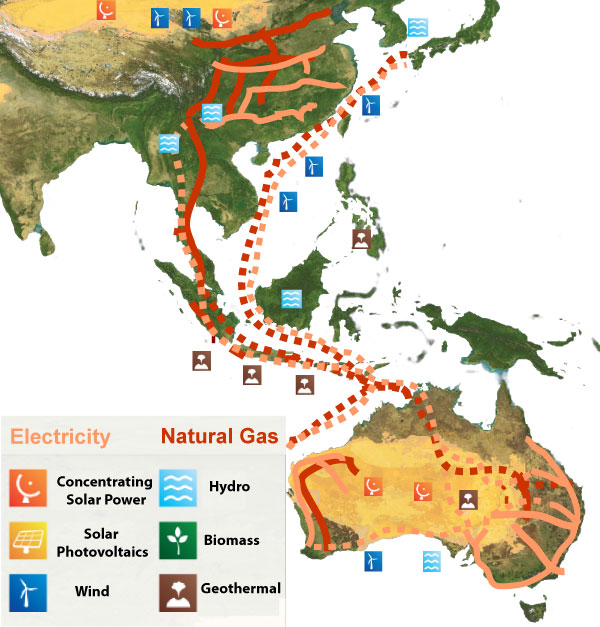

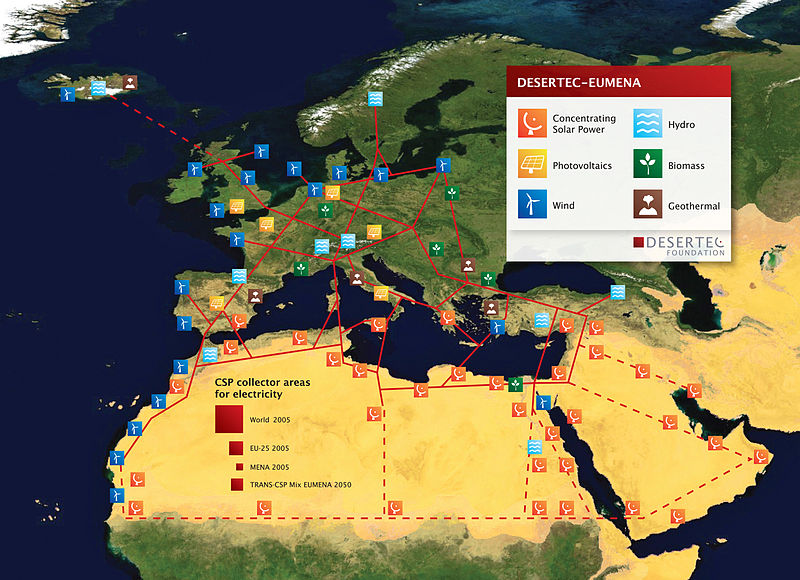

Analog of Internet's Fiber-optic Transformation in Clean Energy:

Finally, one phenomena we saw in the Internet era was that

the new ISPs built their own long distance networks, driven by falling

costs in optical networking. When renewables can be firmed up with

storage, and the costs of solar/wind/storage continue to drop, while

land costs start to become important, and mismatches in time and space

matter, it may become economical to locate renewable farms in places

like deserts in other countries (eg: Australia, Middle East, Africa),

and have "cheap" long distance transmission networks "wheeling" the

firmed renewable power to population centres. A few of these concepts

(eg: DesertTec, and ours) are illustrated below: the basic idea is to be

agnostic to the specific combination of renewables (subject to economic

/ technical feasibility) and build large interconnection links that

span time zones - especially in the east-west directions so that

time-of-day differentials will create a market (eg: India's morning

power supplied by Australian sun, and evening power supplied by a

combination of Australian wind and Middle Eastern sun. The new utilities

like SunEdison, NRG etc will also start investing in their own

transmission networks just like in the Internet era. We will first see

this kind of transmission networks within countries; multi-country grids

are being deployed in Europe currently as well.

No comments:

Post a Comment